Do You Need A Bank Account For Bitcoin

- Does Bitcoin Require Bank Account

- Do You Need A Bank Account For Bitcoin

- Do You Need A Bank Account For Bitcoin Wallet

- Can You Use Bitcoin Without A Bank Account

- Do You Need A Bank Account For Bitcoin Accounts

- Do You Have To Have A Bank Account For Bitcoin

- Can You Buy Bitcoin Without A Bank Account

Every so often at Coinmama, we get a question that makes us scratch our heads, rethink how we explain things, and go back to Bitcoin basics. Recently that question was “Can you tell me how to transfer Bitcoin to bank account?”

Experienced cryptocurrency buyers will know that the answer to that question is, “You can’t.” And while, sure, it’s tempting to leave it at that, we’re Coinmama, this is a family, and we’re not going to act like a sullen teenager! Nope, like a good Coinmama, we’ll do our best to unpack the question, figure out what’s really being asked, and how to answer the impossible.

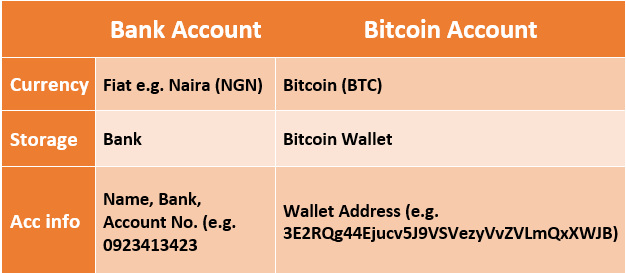

Creating a bitcoin account is necessary so that you can trade, send, or receive bitcoin, convert it to cash, or use bitcoin for purchases. It’s basically a virtual bank account but, unlike traditional bank accounts, they’re not insured by the FDIC, and are not managed by banks so there are no physical checks or ATM cards to use.

A short history of Bitcoin

- How do I change my cryptocurrency to USD? (Bitcoin, Bitcoin Cash, etc.) Why do I need a Digital Wallet? (Bitcoin, Bitcoin Cash, etc.) What’s the benefit of using cryptocurrencies with Bovada? (Bitcoin, Bitcoin Cash, etc.) Can I lose all my money if a cryptocurrency fluctuates? (Bitcoin, Bitcoin Cash, etc.) Are cryptocurrencies secure?

- Before you can buy Bitcoin with a bank transfer, you need to find an exchange that works best for you. Bitcoin is actively traded online and there are dozens of exchanges that you can sign up for if you’d like to purchase the digital currency. Almost all cryptocurrency exchanges allow their customers to buy Bitcoin with their bank accounts.

- But Tesla could now become a bitcoin banking hub Free bitcoin wallets are available for all major operating systems and devices to serve a variety of your needs. In fact, there are 4 ways to do that: Sell Bitcoin on the crypto exchange and get money directly to the bank account. In the United States you can buy bitcoin with a connected bank.

Let’s back up and take a minute to look at why you can’t simply transfer Bitcoin to your bank account. After all, if you’re in possession of a foreign currency, you can go to your bank branch and deposit it into your account at the current exchange rate. So why not Bitcoin?

The answer to this goes back to the origins of cryptocurrency as a decentralized currency. In 2008, in the wake of the financial crisis and with the banks on the brink of collapse, people were becoming distrustful of the banking system and wanted more control over their own economy. It was becoming more and more apparent that there was a need for a currency that wasn’t controlled by a central bank. Out of that need, Bitcoin was born as a decentralized global currency, one that was peer-maintained and eliminated the middle man, one that provided transparency. A currency that was different from other currencies.

In other words, Bitcoin was developed to exist outside of the banking system as we know it. So while it still functions the same way as a traditional fiat currency, it isn’t one. And because of that, you can’t simply transfer the Bitcoin you hold to your bank account. Why? Because even though it exists in tandem with fiat currencies, putting Bitcoin into the centralized banking system would be antithetical to its intent.

We are living in a material world…

Despite your interest in the financial revolution, you’re still living in a world that largely depends on fiat. After all, most landlords (and coffee shops) aren’t accepting Bitcoin for payment yet. So what happens if you’re in possession of a virtual handful of Bitcoins? Where do you store them? How do you use them? And if you’re not yet in possession of them, how to you buy those Bitcoins we speak of? There are so many questions! If you’re asking how to transfer Bitcoin to your bank account, you’re probably really asking one of those questions. Fret not! Coinmama has answers!

How to store Bitcoin: You can’t transfer Bitcoin to your bank account, but you still need to store it somehow. Before you buy Bitcoin, you need to set up a wallet that’s just for cryptocurrency. It is, in many ways, your Bitcoin bank account. There are wallets that are better for everyday crypto use, and there are wallets that are better for housing large sums that won’t be touched for a while. Many people even have more than one wallet—think of it as your checking and savings accounts for cryptocurrency!

How to use Bitcoin: While the ability to use Bitcoin as an everyday currency still isn’t widespread, it’s becoming more and more available. Many online retailers as well as some brick and mortar stores make paying with Bitcoin as easy as scanning a QR code. In other words, trade in your debit card for your wallet app—no bank account needed!

Of course, neither storing nor using Bitcoin is relevant if you don’t already have Bitcoin. Luckily, while we may not be able to help you transfer Bitcoin to your bank account, if you still need to buy Bitcoin, Coinmama makes that part easy.

You want to know how to cash out bitcoin to your local currency and directly into your bank? This is arguably the only guide you will need to read to start cashing out or spending your cryptocurrencies like fiat starting from today.

In this guide we will be looking at seven (7) ways to cash out bitcoins and other cryptocurrencies you might have accumulated:

- One-on-One Transactions

- Cryptocurrency Exchanges

- Peer-to-Peer (P2P) Exchanges

- Crypto Loaded Prepaid Cards

- Crypto-Backed Loans on DeFi platforms

- Your Local Private Bank

- Over the Counter (OTC) Markets

These are practically the safest, fastest, and least expensive ways of converting your bitcoin and other cryptocurrencies to fiat.

Fiat refers to your government-issued physical currency.

How to Cash Out Bitcoin – Factors to Consider:

Your choice of which method to use in cashing out your cryptocurrencies may be influenced by:

- The ease and cost of cashing out your crypto.

- How you want the money – physical cash, bank deposit, or other forms of electronic money like PayPal.

- How soon or urgent you need the cash.

- The local currency and your government’s regulations regarding bitcoin transactions.

- The amount of bitcoin you want to cash out.

So, without much ado let’s examine in detail how to cash out your bitcoin and other cryptocurrencies to cash and directly into your bank account.

1. How to Cash Out Bitcoin in One-on-One Transactions

This is probably the fastest and least expensive way to cash out your cryptocurrency – cash out your bitcoin by selling it directly to another individual looking to buy the coins and get them to pay you in your local currency either by physical cash or bank deposit.

What do you need for successful one-on-one bitcoin cash-out transactions?

- Someone else who wants to buy bitcoin and willing to deal directly with you.

- Your ability to transfer bitcoin from your wallet to their wallet.

- The person’s ability to pay you the physical cash equivalent of your bitcoin.

This transaction can happen face-to-face in your living room, at a bar or restaurant in your neighborhood; and it can also be executed via text, chat, mail or other means of communication if the other person is not within the same geographical location as you.

However, you can’t do a long-distance transaction with a stranger –will you? NO. So this method is only workable when dealing with someone you know so well like your parents, siblings, spouse, colleague, and other close acquaintances.

2. How to Cash Out Bitcoin through Cryptocurrency Exchanges

Cash Out Bitcoin Directly to Bank from Exchanges

Several major cryptocurrency exchanges such asBinance, Kraken, Bitstamp, and Coinbaseto name a few have integrated fiat gateways that make it possible for their customers to transact between fiat and cryptocurrencies.

Binance, for example, has partnered with Advcash (Advanced Cash LTD) to make deposits and withdrawals of fiat currencies such as EUR, RUB, UAH, and KZT possible on their platform.

Coinbase also, –one of the most regulated and trusted cryptocurrency exchanges in the world offer a safe and convenient way to cash out your bitcoin to fiat on their platform; but first, you have to link your bank account or Credit and Debit Cards to the exchange and complete the compulsory KYC verification process –this is standard practice and requirement among all cryptocurrency exchanges that deal with fiat.

More so, in compliance with KYC and international Anti-Money Laundering (AML) regulations; most cryptocurrency exchanges will require you to verify your bank account by making a small “test deposit” before you can cash out bitcoin through their services and you may only withdraw to the same account that you deposited with.

It’s something you should take note of when trying to initiate crypto cash-out transactions.

How long does it take to get my money from Exchanges?

Let’s take Coinbase for an example.

- For US customers on Coinbase, withdrawals to the bank take between 1-5 business days (depending on the method used)

- For European customers withdrawals to your bank account via SEPA transfer generally takes 1-2 business days and 1 business day for withdrawals via wire transfer.

- UK customers can expect to get the money into their bank account within 1 business day.

- PayPal withdrawals are instant for US, Europe, UK, and CA, customers –check theCoinBase FAQfor daily payout limits

Please note that there are usually transfer fees and other charges you might incur for the withdrawals.

Check with the respective exchanges you use for the latest information on applicable charges and withdrawal policies.

One of the major advantages of using this method is that you can withdraw a reasonable amount of money based on the level of your KYC you have completed without much stress and they’re relatively safer.

More so, you can cash out several other supported cryptocurrencies on the exchanges along with bitcoin.

However, if you prefer a more anonymous and faster method of cashing out your crypto, then you may want to consider using peer-to-peer exchanges like Paxful and LocalBitcoins.

3. How to Cash Out Bitcoin Using Peer-to-Peer Exchanges

The most popular peer-to-peer exchanges you can use to convert your bitcoin to fiat are LocalBitcoins and Paxful.

These two popular bitcoin market places operate in almost all countries of the world so anyone reading this guide right now can access them and use their platform to cash out bitcoin to fiat and directly to their bank.

As the name suggests, Peer-to-peer exchanges provide the platform for individuals to trade bitcoin among themselves without involving a third party.

Peer-to-peer exchanges are mostly escrow-based with a transparent and straightforward fee structure.

These exchanges offer certain advantages which make them appealing to many cryptocurrency enthusiasts looking to cash out bitcoin:

- Peer-to-Peer exchanges offer greater anonymity.

- Peer-to-Peer exchanges offer users the ability to negotiate exchange rates.

- Peer-to-Peer exchanges offer greater speed

However, there’s a high possibility of getting scammed if you’re not vigilant –that’s just the basic draw-down of this option to cash out bitcoin -security is not top-notch like the regular cryptocurrency exchanges.

How Does Peer-to-Peer Exchanges Operate?

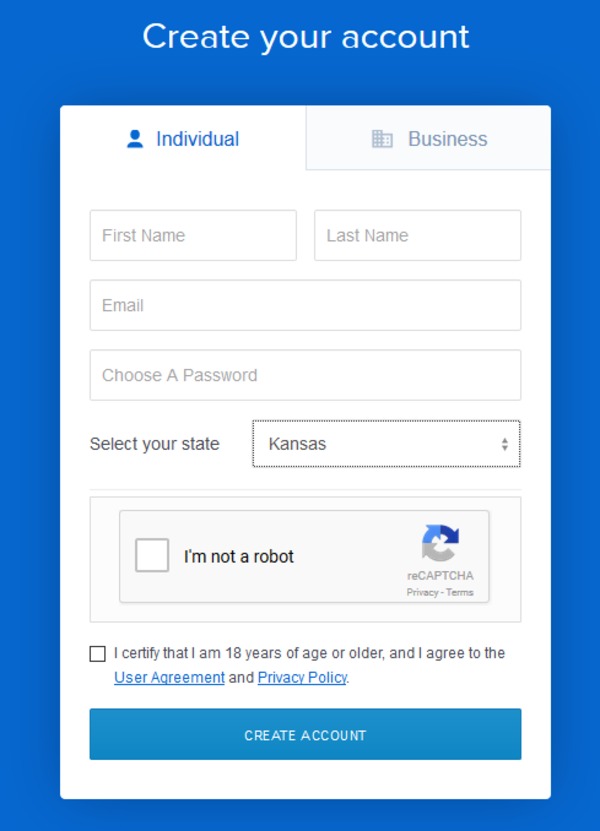

First, you need to open an account on any of the exchanges –for example, LocalBitcoins; then complete your profile setup and place a trade request to sell bitcoin.

You can specify your preferred payment method. Some of the payment options include:

- Bank transfers

- Cash deposits

- Gift vouchers

- Skrill, Payoneer

- Western Union

- Neteller

- PayPal

- Mobile money

- Meet in person in your neighborhood and trade for cash settlement

Once you get a buyer, both of you can negotiate rates and then initiate the transaction. Your coins are locked in the escrow wallet until you confirm receipt of cash.

Neither you nor the buyer can access a coin that’s held up in escrow during a trade until the deal is successfully closed and if any problem arises along the line; the admins will step in to verify your claims and settle the dispute accordingly, based on evidence.

Make sure you’re trading on reputable peer-to-peer exchanges to avoid scams. The platform itself can scam users, so be vigilant and read exchange reviews before you move your funds there.

4. How to Cash Out Bitcoin Using Crypto Loaded Prepaid Cards

Crypto Loaded Debit Cards

The drive for crypto mass adoption has led to many projects introducing innovative products aimed at bridging the gap between crypto and fiat; thus making it super easy for ordinary people to be able to buy and sell cryptocurrencies easily.

One of such efforts to make the crypto to fiat conversion smooth and convenient for most users is Crypto Debit Cards.

The cards are preloaded with bitcoin and any other supported cryptocurrencies the issuing Company supports and can be used to withdraw your funds across millions of ATMs around the world or simply use for shopping on thousands of online merchant stores and in-store POS terminals that accept Visa or MasterCard worldwide.

Does this sound like a way to go in your search for how to cash out bitcoin to fiat?

Let’s examine the various Crypto Debit Card providers in the market, then you can decide which of them you will apply to get their card and start spending your crypto wealth easily.

Best Crypto Debit Cards:

Some of the best cryptocurrency debit card you can consider applying for include:

- Nexo Mastercard–access your money worldwide with zero foreign exchange fees. Monitor your transactions on Nexo Mobil App and enjoy 5% cash-back on all your purchases with the Nexo Mastercard.

- Coinbase Card–allows you to instantly spend the funds in your Coinbase account. Available to Coinbase customers in the UK, Spain, Germany, France, Italy, Ireland, and The Netherlands. The Card is useable anywhere that Visa payments are accepted.

- Wirex–One of the most established companies in the space with over 2 million customers and transaction volume of $2 billion.

- Revolut–Spend abroad with no fees.

- BitPay Visa Card– The BitPay prepaid Visa card is only available to US citizens and are globally useable everywhere Visa cards are accepted.

- MCO Visa–available in Singapore and over 30 US states and counting

- Bitwala–a secure card designed for global spending

This list is by no means exhaustive but they’re the top existing products in the market for you to choose from.

So what factors should guide your choice of a card?

- Is the card supported in your region?

- Is it user-friendly or full of complicated processes?

- How secure are the card and the issuing platform?

- Is the card reliable? Visa and MasterCard linked cards are more reliable.

- What are the fees structure and is this transparent? You wouldn’t want to SHARE your money with some crypto card Companies in the name of transaction fees.

- Does the card support multiple cryptocurrencies and fiat? How many fiat currencies does it support? Is it globally useable?

You will need to take your time and evaluate the various options and choose cards that provide the features that are most important to you.

Now you can carry your crypto everywhere you go with a smart crypto card.

5. How to Cash Out Bitcoin Using Crypto-Backed Loans on DeFi platforms

What if you never really need to cash out bitcoin?

What if you can spend all the cash your bitcoin is worth without actually selling your bitcoin?

What if you go on this spending spree and still enjoy any future price appreciation of the same bitcoin?

All these are made possible by Crypto-Backed Loans on DeFi platforms.

We can simply call them “crypto banks” or “blockchain banks” providing financial services on the blockchain.

How does it Work?

- You deposit your crypto into the platform.

- You request a cash advance and the Company transfer the fiat into your bank account.

- Your deposited crypto is held as collateral for the cash advance.

- Once you pay back the money you collected, you get your coins back.

That’s just how simple it can get.

So what are the benefits of using this method?

Does Bitcoin Require Bank Account

- It’s a legit way of avoiding being taxed as you are not selling your bitcoin. You’re simply taking loans and loans are not taxable.

- You still enjoy any future appreciation in the price of bitcoin or whatever cryptocurrency you have deposited. If bitcoin was $10, 000 when you took the loan and when you come to pay it back the price had risen to $20, 000 your wealth just doubled even while you’re spending it –amazing.

Several companies providing this service including MakerDAO,Nexo,EthLend,Salt, and many others in the market.

As is always the case, review the platforms carefully before depositing your bitcoin.

Do You Need A Bank Account For Bitcoin

:max_bytes(150000):strip_icc()/dotdash_Final_Why_Do_Bitcoins_Have_Value_Apr_2020-01-0a8036d672c34d69bd2f4f5175b754bb.jpg)

6. How to Cash Out Bitcoin Using Your Local Private Bank

Cash Out Bitcoin Through your local bank

If you are trying to cash out bitcoin worth millions of dollars, you will find that going through a private bank may be the best choice for you.

The bank can help you facilitate both the sale as well as the movement of the fiat equivalent to your desired destinations.

More importantly, why you may want to consider using a private bank is that you will get more professional help with receiving your funds without getting your account frozen due to heavy and sudden cash flow.

7. How to Cash Out Bitcoin Using Over the Counter (OTC) Markets

A certain volume of crypto transactions is simply not possible with any of the aforementioned options and that brings us to the last item on the list of ways to cash out bitcoin –Over the Counter (OTC) Markets.

What are OTC Markets?

Over-the-counter markets are avenues for participants to trade directly between each other, without the use of a central exchange or other third parties.

In practice, traders in an OTC market really don’t trade directly with each other but goes through what we call OTC desks or exchanges.

OTC desks are maintained by some of the major exchanges such as Binance, Coinbase, and Circle to accommodate traders who are willing to sell large amounts of coins, like miners or early crypto investors who have accumulated millions ad even billions of dollar worth of coins.

More so, there are crypto millionaires and billionaires looking to buy crypto without using the public exchanges.

You can cash out bitcoin worth millions of dollars by approaching any of the popular OTC market providers and negotiate rates with them.

Do You Need A Bank Account For Bitcoin Wallet

They have been known to facilitate the large volume of crypto transactions this few years and so far remains the top place to cash out a large amount of coins anonymously and securely.

Can You Use Bitcoin Without A Bank Account

If you think the OTC market is free of scammers –you’re wrong. The big scammers – like hackers operate here and the same caveat “beware of scammers” applies in this market too if you don’t want to lose huge.

Do You Need A Bank Account For Bitcoin Accounts

On a Final Note

There we have it –seven (7) ways to cash out bitcoin. As the cryptocurrency industry matures, better and more advanced means of converting your crypto wealth to cash are being developed and released into the market.

Spending your cryptocurrency shouldn’t be a difficult process and we hope that with this guide you find at least one method that works just fine for you –balancing anonymity with security and speed.

Always speak with your lawyer, banker, and other relevant experts when large amounts are involved so you don’t fall on the wrong side of the law or worse –get scammed of your crypto money.

Do You Have To Have A Bank Account For Bitcoin

What other ways do you cash out bitcoin to fiat and bank? Share with us in the comments section below.